Practical house repossession advice & 4 solutions

Under UK house repossession laws if you fail to keep up with your mortgage payments your property is at risk of being repossessed. If you are potentially facing repossession your options could be very limited. On this page, we will take a look at the process and provide you with some practical house repossession advice that can put to use.

House repossession laws you can't ignore!

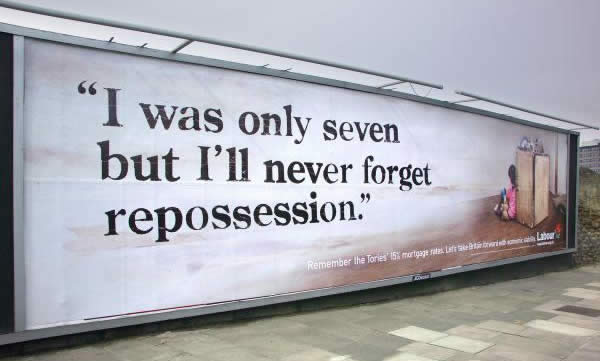

If you have ever met anyone who is facing repossession, or if you're in that situation yourself, you will probably be aware of the feelings it causes such as anger, embarrassment, fear, and a whole host of other emotions that aren't very nice. No one would want to go through such an experience.

In some cases house owners have actually paid off a significant amount of their mortgage debt but due to financial difficulty are still struggling to keep up with payments.

What you rarely hear about is what the UK process actually is, what the rules and consequences are, and how they can be avoided.

The house repossession process

There's 5 key stages:

• Stage 1 – The lender attempts to contact you to say your mortgage is in arrears, and requires bringing up to date. If you don’t contact your lender now, it will move to the next stage

• Stage 2 – the lender starts repossession proceedings, and their solicitor will contact you to ask for the amount owed and notify you that you face repossession if it isn’t paid within a certain time. Ignoring this will land you at stage three.

• Stage 3 – The lender starts the formal repossession procedure with the court. They will need to provide details of the debt owed and other details of the case, and it will probably be done in your local county court.

• Stage 4 – If the lender has got its facts right and the court agrees, an Order for Possession will be granted. 28 days after this the lender can legally repossess your house, unless you have paid them back in that time.

• Stage 5 – 28 days have passed and the lender can now evict you and take possession of the property. If that happens you lose the property, your credit rating takes a very heavy hit that will impact it for years, and the lender can still sue you for any shortfall between what they sell the property for and what you owe them.

The consequences of being repossesed are very severe

You have 4 options to Stop repossession

You probably won’t be aware of it, but it is possible to stop bank repossession or avoid voluntary repossession at almost any point in the process. It’s not difficult to do either, as long as you know what your options are.

1. Keep up with existing payments

The first thing is fairly obvious – don't get behind with your mortgage payments or arrearsin the first place. Of course, that's easy enough to say and it may be that you just have an unfortunate situation that you have been able to get out of. If that's the case, then read on for the next tip.

2. Change your deal

Secondly, if you are experiencing difficulty in making payments or think you might be about to, see if you can change your mortgage deal. Go to another lender with a better rate if you can, as this will cut the payments down and might make the difference.

3. Speak to your current lender

If changing lenders isn't possible due to you already being in arrears or having negative equity, then you need to speak to your current lender urgently. Believe it or not they will want to help as it isn't in their interests to repossess the house unless they really have to as they rarely get back the money they have lent on it. Possible solutions that they may agree to include payment holidays for short-term problems, extending your mortgage term or changing from repayment to an interest only mortgage for a time.

4. Sell your property

If you really comes down to it and you can’t do anything else to avoid repossession, then you really need to consider selling your house. Doing this at the right time can result in repossession proceedings being stopped altogether, and leave you with enough money to pay off your outstanding mortgage.

This is where House-Quick-Sell® can help, we are able to purchase your property from you for cash allowing you effectively pay off your entire mortgage in one lump sum, and can often make the purchase in as few as seven days after you first contact us. Even right at the last minute, our stop repossession service can come into play. Put simply, this means that once you have agreed to sell your property we obtain a stop on the order allowing the sale to be completed and allowing you to receive the money for the sale without repossession or any consequences with the law.

Clear debt, avoid repossession and start again

Don't even think about voluntary repossession, we can help with even extreme cases!

- House-Quick-Sell® has delt with hundreds of repossession or debt related cases across the UK

- Our buying team is very experienced even dealing with the most extreme cases

- Unlike other organisation who claim to buy quickly. Our actual cash status means that we’re in a position to act quickly to pursue the purchase of your house

- We can complete the sale of your house within days, which means that you will be able to continue your life without having to live with uncertainty.

Contact us or call 0800 0845 025 to speak to one of our advisors. Our experienced, friendly advisors will guide you through every step of the sale process, and in matter of just a few days, you can have your home sold and debts paid off. For detailed information about some of the things discussed on this page visit Shelter charity's repossession advice centre.

Popular tips and advice about house repossesion

These free tips advice have been put together by our property advisors to help you with answer any repossession related issues you may have.

Repossessed property in the UK is on the rise - spotting the trends

Home repossession stopped: How we stopped a bank repossession (real case study)

Voluntary Repossession: BEWARE - It isnt an Easy Option!

Our most popular tips, advice and guides for home owners:

UK homebuyers: AVOID or a Legitimate option?

UK homebuyers: AVOID or a Legitimate option?

Property buyers: 6 MUST READ tips before you Sell

Property buyers: 6 MUST READ tips before you Sell

We buy any house: Is that REALLY true or just a lie?

We buy any house: Is that REALLY true or just a lie?

Never again have to ask "Who will buy my house?"

Never again have to ask "Who will buy my house?"

The 5 essential steps to achieve a quick house sale

The 5 essential steps to achieve a quick house sale

Cash for homes in Less than 7 Days

Cash for homes in Less than 7 Days

READ this article if you need to sell my house fast

READ this article if you need to sell my house fast

House buyers: The 5 key Benefits you should expect

House buyers: The 5 key Benefits you should expect

"It was very good, got the information straight away and it went through very quickly"

"It was very good, got the information straight away and it went through very quickly" "Straight talking, straight dealing", "Very good, very professional"

"Straight talking, straight dealing", "Very good, very professional"